Sign up to our newsletter to get updates on new articles.

The following is a highlight post from the Emerging newsletter by Pondering Durian.

In this piece, I’m thinking out loud about how software may evolve in different geographies. Clearly, labor costs play a role in any automation decision – and labor costs are very different in the developed vs. the developing world. However, I think a bigger factor is the shape of economic activity – the distribution of jobs by organizational size largely derived from developmental maturity during the industrial era.

Many folks have assumed the developing world is simply a few decades behind the developed. In its thirst for ever cheaper labor, capitalist incentives will push supply chains to the furthest shores of the developing world and plant the familiar seeds of industrialization. The complex corporations that spring up would require the same familiar acronyms – ERP, CRM, HR management – to digitize their operations and successfully compete in the global economy alongside other multi-national titans.

This seems unlikely.

Clearly, enterprise software giants are and will continue to penetrate the corporations of Emerging Asia. The point is the long-term opportunity of traditional enterprise offerings may be smaller than pundits forecast. The software industry will evolve to reflect the underlying economic activity. And the reality is the economies of Emerging Asia are digitizing before they are industrializing.

Perhaps the future of software looks less like the West – enterprise software solutions to digitize industrial era corporations monetized via recurring upfront fees — but will mirror the underlying economies of Emerging Asia: a bifurcation of big tech platforms and the SMEs which they serve – monetized via commission and financing solutions to boost growth.

Given the enhanced role they are destined to play (and the regulatory heat emerging in the US, EU, and China), I’ll posit the ultimate champions of aggregation in Emerging Asia will need to make politically motivated concessions. A sort of self-regulation – sacrificing some short-term growth (once network-effect escape velocity) – for long-term economic health.

The key question: will large tech platforms in Emerging Asia take over certain roles of the state to cushion the traditional power-laws of the internet and help foster a growing middle-class as the well-trodden industrial path seems to be closing?

Let’s dive in.

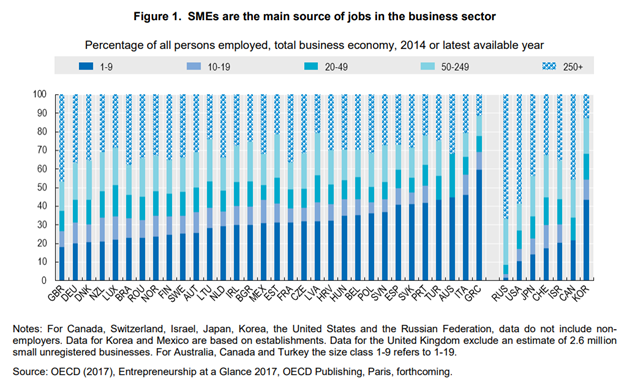

The Missing Middle

The ‘missing middle‘ is a common phrase in developmental economics. The phrase refers to the lopsided distribution of businesses in poorer economies: a small number of large firms, a very low number of mediums sized firms, and the dominance of <10 person micro businesses. In the developed world, employment contribution from companies of >50 people is substantial – accounting for about 70% of employment in places like the US.

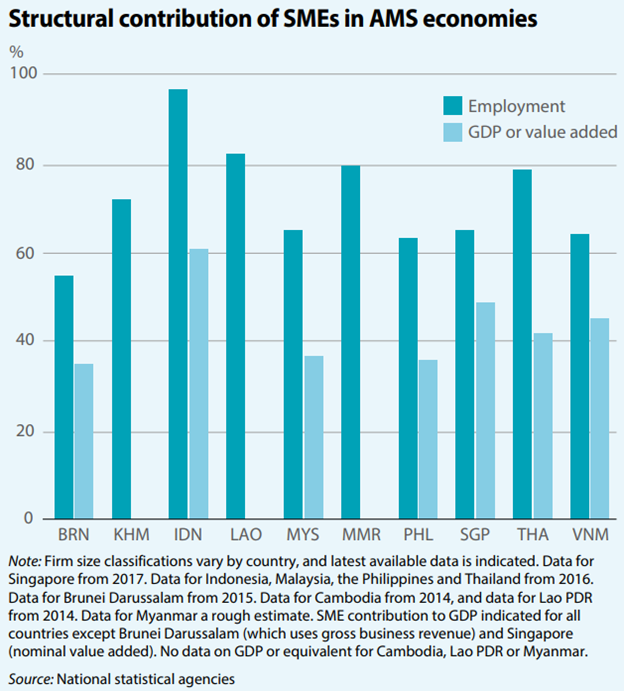

However, the ratio is often inverted in poorer places like India or Southeast Asia where MSMEs dominate in terms of livelihood.

Clearly, these regions did not enjoy the same reshaping of economic activity during the industrial era: riding the manufacturing -> urbanization -> higher productivity -> higher wages-> services to cater to those with higher wages – economic boom of other ‘developed’ regions. In much of the economy, the complexity of economic activity never reached a threshold requiring the diverse skillsets to produce sophisticated goods – let alone multinational corporations managing global supply-chains; at least not to the same degree. Most businesses remained tiny.

In contrast, the developed world saw the median size of the enterprise balloon to manage the ever-increasing complexity of global value-chains and high-end manufacturing. More complexity generally meant more people.

At least until now.

As the 20th century industrial economy gives way to a 21st century digital economy, we are seeing a reversal in the shape of economic activity – and specifically in the shape of employment. The previous corporations built up during the industrial era are being unbundled by enterprise software. Every single non-core business process is a massive software business in the making. The insatiable march of automation creeping from front-line cashiers and bank-tellers into the back-office with its sights on corporate HQ. The exhaust fumes from this juggernaut are spewed into the ‘gig economy’ – a combination of big tech and micropreneur – resembling the tailed distributions more familiar in the emerging world.

In India and Southeast Asia, there isn’t much of a middle to hallow out. Given the distribution of employment, the biggest opportunities come not from digitizing corporations, but from digitizing SMEs, solidifying the classic bifurcation of big tech and the micropreneurs they serve. This follows the Chinese examples of Taobao, Meituan, Didi, and even Douyin to bring the sprawling SME and artisan class into the 21st century.

The Indian and Southeast Asian ecosystems are following a similar path; the race to be the preferred partner for SMEs is on. In Southeast Asia, Shopee, Lazada, Tokopedia, Bukalapak, Sendo, Tiki and more are jostling to build supplier liquidity on C2C marketplaces. Grab and Gojek are fighting over drivers and food-delivery. Grab Financial, GoPay, Momo, VNLife, Mynt, Paymaya, and Truemoney are a top the scramble to modernize payments, O2O marketing, and digital financial services for SMEs. B2B marketplaces like Ralali, Telio, Bukalapak Mitra, Warung Pintar are clashing (or partnering) with Point of Sale and basic accounting tools like Moka or BukuWarung – striving to own the offline merchant workflows where they are running smack into eWallets. And the enterprise software solutions are duking it out, fighting tooth and…no enterprise titans. India is the same story, different names: Flipkart, Swiggy, Zomato, Google, Facebook, Jio, Paytm and a host of others striving to embed themselves with the economy’s largest opportunity – the SME.

Emerging Asia is skipping the unbundling middle and heading straight for the end-state.

While digitizing SMEs is commendable, digitizing before industrialization may have unintended consequences in terms of distributing the gains. For the lucky few capable of a coveted job at a large tech firm, this means even more white space for the digital economy to attack. For consumers, it means access and cheaper goods and services. For the SMEs, it means efficiencies, convenience, and new customers. It also means fiercer competition.

A Preview: Why the ‘Passion Economy’ is not the answer

As these platforms ramp up in the developing world, we can look to the West again for inspiration of the end state. The unbundling of the corporation has birthed a lot of discussion around the growing ‘gig economy’. Large platforms like Uber or Task Rabbit which provide a technology-enabled aggregation layer to match demand for a service with the corresponding ‘contracted’ supply. While this arrangement provides flexibility and job creation, common complaints are that the gig economy is not as stable as traditional employment and the platform aims to commoditize the supply as much as possible (often with the end goal – like Uber – of taking the human out of the loop).

In San Francisco circles, the gloom of the gig economy is being replaced by hope in a rising ‘passion economy’ (Li Jin, a16z) nurtured by similar tech-platforms or aggregators empowering creators through new software tools. However, as opposed to commoditizing the supply, these platforms – like Substack, Shopify, Udemy or TikTok – seek to automate many tedious business processes and showcase users’ unique skills or products online. Differentiation replaces commoditization. It’s not a stretch to say the corporation is beginning to be unbundled into solo-entrepreneurs and the specialized modular tools: customer acquisition, website building, payments and video editing which empower them.

While inspiring, I find it naive to think the creator economy will make a material dent in employment and inequality. More likely, the ‘passion economy’ will bring the same power-law distributions we are seeing at the corporate level to the creator level; bringing the internet’s Machiavellian touch to the localized offline world of Emerging Asian SMEs.

With supply-chains reshoring, automation rampant, and the pandemic raging, many consumers and small business owners have no choice but to turn to online channels. Unfortunately, this shift often introduces competition from national or even global aggregators in many products and services. From a prior post discussing the inverse economic relationship between aggregators and their onboarded vendors:

The outcome for the individual vendors (think SMEs or individual creators) on each platform is subject to different economics due to the aggregation level of the platform (global, national, or local). A musician on Spotify has global distribution, meaning (almost) anyone in the world can download the app and enjoy his/her music. However, this also means he/she has global competition. In a market of global liquidity, the competition is exceptionally intense. The very best are compensated handsomely while the vast majority struggle to be found…

However, the equation is largely inverted for hyper-local platforms (ride-hailing, food-delivery, etc). While the competition at the platform level is intense – onboarding supply and demand is more tedious (without global network effects) – the competition on the supply side level (think SMEs) is tamer. Restaurants are notoriously cut-throat, but generally only must compete in a given neighborhood. The level of competition for the MEDIAN seller on the platform – and the corresponding profit pool – scales up and down with the level of aggregation (of the platform; local to global) which largely depends on the business model and the real-world constraints (typically physical or regulatory barriers).

Unfortunately, many of the largest and fastest growing categories globally have either national (think eCommerce) or global (any digital good like Netflix) aggregation effects. As internet penetration takes off, the local Indonesian SMEs selling Batiks will now have to compete with every other SME on Shopee, Tokopedia, Lazada and Bukalapak, not just those in a 3km radius. Any digital yoga instructor will have to compete with an army from the same time zone – not to mention the infinite number of free – high quality videos on YouTube.

Similar to the disappearing middle in the broader economy – with software eating away traditional corporate jobs and pushing individuals into the ‘gig’ or ‘creator economy’, the creator economy will see an equally if not more stark bifurcation between a small group of “haves” and everyone else. Many small businesses in the ‘passion economy’ are digital in nature and largely dependent on attracting attention. Unfortunately, the attention economy is one of the few arenas which actually is zero-sum.

The Internet and Nietzsche’s Meritocracy

While hailed as the ‘great equalizer’ by ‘democratizing access to information and opportunity’, we are rapidly learning the internet actually brings cut-throat meritocracy. And meritocracy, by definition, breeds inequality. The best companies in the world will own niches in a value-chain and will replicate endlessly. The best search engines will be used by everyone. The best musicians will play for us all. The best educators can reach millions.

On the demand side of the equation, this is amazing. I can listen to the world’s best musicians, read the best writers, and buy the cheapest goods. On the supply side, the equation looks less rosy.

Societies are beginning to wrestle with this uncomfortable truth and for the first time since the end of the Cold War, to question raw meritocracy as a means of distributing resources. Political movements are rapidly mobilizing – populism on both the left or the right advocating for either the redistribution of wealth or protectionism in immigration / trade policy to buffer the onslaught from abroad. The question is not if but how much.

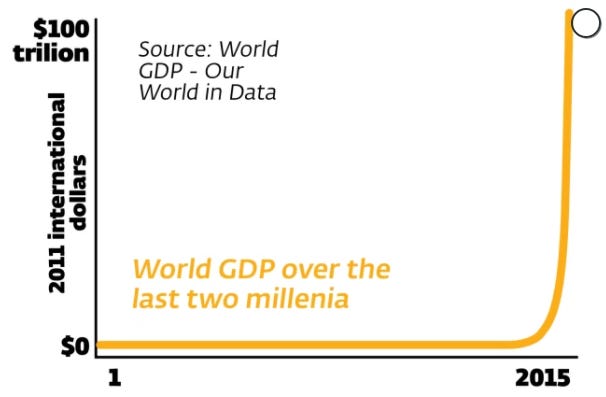

After more than 30 years of exposure to raw meritocracy, many are starting to question its merits. A dicey proposition. On the one hand, “the market” is just a collection of individuals freely voting with their dollars and – examining living standards since its inception – birthed perhaps the greatest engine of human prosperity in world history.

On the other hand, many of those dollars are now ending up in the same place.

The stereotypical corporate or manufacturing jobs providing stability and cushion in the 20th century are in the early innings of being unbundled into a massive cut-throat gladiatorial arena online. The utopia of technological abundance slowly replaced with a dystopian dream: every man and woman going mano-a-mano with more than 4 billion others. While the profit pool will increase, the new super-powers of global distribution for the top 1 per cent are likely to make pure meritocracy untenable for the median individual. Maintaining the incentives to produce while ensuring rising living standards for those unable to compete, while finding a way to protect the dignity and purpose of work is the high-wire act of our time.

I, personally, have always been a fan of more marginal steps to change. While emotionally tempting, revolutions have not treated their inhabitants well. While change is inevitable, moving too rashly may kill the golden goose we have milked for the last 200 years. Despite the headlines of turmoil, it appears we have stumbled upon a relatively good formula.

However, with new technologies like the internet and artificial intelligence structurally tipping the scale in favor of a minority already in the lead, cries to change the rules will only get louder. In established Western democracies, those changes will likely happen at the ballot box. We are already seeing the rise non-traditional politicians who promise increased protectionism or redistribution. While this may hurt absolute productivity, it will likely salvage an economic system which appears to have gotten much else right. Unfortunately, much of the emerging world doesn’t have that luxury.

The online shift caused by the pandemic – reeling in 3 years of digital penetration in just 3 months – will only exacerbate the ‘missing middle’ in Emerging Asia; robbing policy-makers of the already precious little time to formulate a plan of attack for the power-law distributions now creeping through their cities.

What happens when the digital revolution arrives and there isn’t much to protect or redistribute? What happens when there isn’t a corporate or welfare safety net? What happens when your zip code in Surabaya is invaded by millions of other shoe sellers from cyber-space?

Sustainable Software: Long-term greedy

Surveying the landscape in Southeast Asia, the pandemic is hitting the median family hard. Catalyzed by mandatory lockdowns to protect fragile healthcare systems, online adoption is sky-rocketing; aggregators serving as a life-line for access to both goods and information; a flood of offline SMEs clawing for the online lifeboat.

With digitization ramping pre-industrial maturity, big tech platforms will play a massive role in facilitating economic activity. East Asia and the West have the benefit of a legacy middle class and welfare apparatus. Emerging Asia does not. Over time, I suspect the winning tech platforms in Emerging Asia will realize their long-term growth ambitions are intimately entangled with the fate of the median consumer they serve.

Without a corporate ‘middle’, the purchasing power of an aggregator’s median consumer will increasingly be derived from another aggregator or tech platform. As opposed to monetizing via up front SaaS fees, these platforms monetize primarily via commission, ads or financial services; almost like a digital tax. The aggregator’s growth is very much tied to overall economic growth. To build a sizable consumer base over the long-term, tech companies may decide to take a more active role in managing the outcomes on the network.

Seeing the populist tech-lash and regulatory clubbings now rampant in the US, EU, and even China, tech titans in Emerging Asia may explore ways to shoot for more equal outcomes online as the traditional middle-class industrialization story is coming into question. As opposed to the laissez-faire slide towards ‘power-sellers’ evident in virtually every marketplace to date, I wonder if big tech in the developing world will begin to take on even more roles traditionally associated with the state: to tweak their algorithms to level the playing field, perhaps boosting the results of smaller merchants as an investment in the long-term health of their ecosystem?

Historically, the stage of economic development and shape of economic activity has dictated software’s evolution. It has seen a need in the market and responded. However, as economies continue to bifurcate, I wonder if tech firms will, for the first time, fight against their own unbundling inertia. Perhaps, instead of accepting the hallowing middle structurally dictated by an internet-inspired meritocracy, enlightened Big Tech Aggregators will evolve to stem its tide.

Not out of altruism, but out of survival.

Emerging is a newsletter going deep at the intersection of tech and finance in Emerging Asia. Subscriptions are free and delivered to your inbox most weeks. Prior musings can be found at emerging.blog.